US vehicle import tariffs and vessel fees are causing uncertainty across North American ports but upgrades to infrastructure through 2024 have given some of the top volume processors room for manoeuvre.

The main vehicle processing ports and terminal operators in the US and Canada are dealing with a lot of uncertainty in the first two quarters of 2025. Current trade policy under the Trump administration is making many reticent about sharing their plans because those plans are having to change on a daily basis in some cases. Vehicles have been and are being stored at ports but there is not a clear picture of the extent of that dwell. What seems certain so far is that the end consumer is going to have to foot the bill for any tariff and port fees that have permanence in 2025.

The current volatility could be cause for a rose-tinted reflection on 2024 but there were some notable investments in port infrastructure for vehicle and equipment processing amongst the bigger volume ports.

Volume at Veracruz

Veracruz is Mexico’s main port for vehicle handling and moves 40% of the country’s total annual volume. Last year the port authority at Veracruz (Asipona Veracruz), and its terminal operators CSI and SSA, increased storage for around 53,000 vehicles over 66 hectares. Veracruz remains North America’s biggest in terms of annual finished vehicle processing. It has seven ro-ro berths, which is unique in Mexico and has direct access to two rail lines served by Ferrosur and Canadian Pacific Kansas City (CPKC).

Together the port authority and its terminal operators have invested 1.1 billion Mexican pesos ($53m) to improve finished vehicle capacity and throughput. CSI, which is an integrated logistics provider, has also added a multistorey parking lot with capacity for 10,000 CEUs.

Asipona Veracruz now also has a more collaborative relationship with the port Tuxpan, almost 300km to the north. Those initiatives are benefitting carmakers, including the three biggest users of the port: Ford, Honda and Volkswagen.

The port exports more vehicles than it imports. Roughly two-thirds of its annual volume (68%) is exported and the port authority has made efforts to support that with lower vehicle tariffs of 5.93 MXP ($0.3) for those exports.

If the port maintains a volume rotation three times a month it now has capacity to move up to 1.6m vehicle units a year. That is helped by the fact that Veracruz has increased its customs gates for vehicle imports from four to 17, which has increased throughput by 240%. It also now has four gates for exports.

In the first four months of 2025, Veracruz moved 199,522, down -22% on the same period last year (257,118).

| Veracruz (VE), Mexico | |||||

|---|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

2020 |

|

|

Imports |

285,126 (-19.5%) |

354,350 (10.4%) |

320,789 (+20.6%) |

265,974 (-8.2%) |

289,889 (-31.4%) |

|

Exports |

565,646 (-2.3%) |

579,253 (+8.09%)

|

535,876 (-3.9%) |

557,727 (+19.0%) |

468,626 (-18.0%) |

|

Total |

850,772 (-8.9%) |

933,603 (+8.9%) |

856,665 (+4%) |

823,701 (+8.59%) |

758,515 (-23.7%) |

Construction at Colonel’s Island

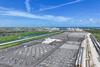

In the US, the port of Brunswick knocked Baltimore off the top spot in terms of vehicle volumes handled in the year by a US port. The Colonel’s Island terminal moved approximately 902,000 vehicle and heavy machinery units in 2024. Finished vehicle volumes were up 13.3% last year (838,420 CEU) and heavy equipment was up 160%, helped by significant investment by Georgia Ports Authority (GPA) and its terminal operators in a massive industrial expansion of vehicle and equipment handling facilities.

A total investment of $262m was pumped into the Colonel’s Island terminal to develop new infrastructure across approximately 40 hectares (100 acres) of property. The overall project accommodates a new vehicle processing centre (VPC) for Nissan North America and the shift of Wallenius Wilhelmsen’s equipment-handling operations from the port of Savannah to Brunswick. It also provides capacity for growth from existing and new carmakers choosing Brunswick as a location to import and export their products.

| Total passenger and light truck handling at Brunswick port | |||

|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

838,420 (+13.3%) |

740,000 (+17.1) |

631,519 (-3%) |

651,535 |

A total investment of $262m was pumped into the Colonel’s Island terminal to develop new infrastructure across approximately 40 hectares (100 acres) of property.

The overall project accommodates a new vehicle processing centre (VPC) for Nissan North America and the shift of Wallenius Wilhelmsen’s equipment-handling operations from the port of Savannah to Brunswick. It also provides capacity for growth from existing and new carmakers choosing Brunswick as a location to import and export their products.

Carmakers and processors at Brunswick port

BMW North America

Glovis America (for Hyundai/Kia)

International Auto Processing

JLR

Mercedes-Benz USA

Subaru of America

Wallenius Wilhelmsen

Volvo Cars of North America

In terms of hinterland services, GPA says that Phase I of a new railyard on the south side of Colonel’s Island Terminal has been completed (as of May this year), doubling rail capacity from five to ten trains per week. That new railyard will increase the port’s annual rail capacity for finished vehicles from approximately 150,000 units to more than 340,000. Phase II will bring annual rail capacity to 590,000 units, greater than three times the current capacity, according to GPA. It also reports that more than 90% of vehicles currently moving by rail in Brunswick are US-made exports.

Separately, construction on a fourth ro-ro berth is in the planning stages and work is expected to begin this summer with a completion date set for 2027. The berth will more efficiently accommodate vessels carrying 10,800+ car equivalent units (CEU).

With regard to the ongoing uncertainty caused by US tariffs on vehicle imports, GPA president and CEO Griff Lynch said at the end of April that it had not affected GPA’s plans to invest $4.2 billion in capacity expansions over the next decade.

“More manufacturers are making Colonel’s Island a main hub for the global trade of autos and machinery,” said Lynch in a address earlier this year. “Brunswick’s central location in the fast-growing US Southeast market and unmatched capacity to take on new business mean our customers can plan for the long term.”

Rebound at Baltimore

Baltimore’s passenger and light truck volumes were down in 2024 by 11% compared to the previous year to just below 750,000, in the main because of the collapse of the Francis Scott Key bridge on March 26 last year. The bridge spanned the Fort McHenry Federal Channel in the Patapsco River outside Baltimore port and its complete collapse into the river following the collision of the Dali container vessel with Pier 17 caused months of disruption to vessel calls, including car carriers. Many were diverted to other east coast vehicle-handling ports, including Brunswick. The Fort McHenry Federal Channel was not fully reopened until June, when the last remanent parts of the bridge were cleared from the channel.

| Vehicle throughput at Baltimore (MD), US | ||||

|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

|

Import |

641,000 (-5.2%) |

676,381 (+17.8%) |

573,831 (+7.6%) |

533,286 |

|

Export |

108,799 (-36.2%) |

170,777 (-3%) |

176,332 (-13%) |

204,832 |

|

Total |

749,799 (-11.4%) |

847,158 (+12.9) |

750,163 (-1%) |

758,118 |

|

Top OEMs by volume |

General Motors, Ford, Stellantis, Volkswagen, Mercedes-Benz and BMW |

|||

Despite the disruption the port handled 45.9m tons of cargo in 2024, which it reported as the second-best ever year after 2023. “These numbers reveal the hard work happening at the port to finish the year strong, despite a challenging start,” said Maryland governor, Wes Moore. “We are especially grateful to our port’s workers, whose indomitable spirit and dedication brought us to this moment.”

A report into bridge safety released in March this year by the National Transportation Safety Board (NTSB) in the US calculated that the risk level to the Francis Scott Key bridge was 30 times higher than the safety threshold established by the American Association of State Highway and Transportation Officials (AASHTO). The NTSB report also finds that 68 other bridges in the US, frequented by ocean-going vessels and built before the AAHSTO guidance was issued in 1991, need assessment for vulnerability of catastrophic collapse. Of those bridges, 34 are classified as critical/essential.

| Lázaro Cárdenas (Mich), MEX | ||||

|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

|

Imports |

440,098 (+6.40%) |

413,613 (+3.66%) |

399,006 (+67.2%) |

238,513 |

|

Exports |

235,287 (-17.5%) |

285,520 (+15.3%) |

247,572 (-0.3%) |

248,355 |

|

Total |

675,385 (-3.39%) |

699,133 (+8.1%) |

646,578 (+32.8%) |

486,868 |

| Altamira (Tamps), MEX | ||||

|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

|

Imports |

8,493 (-68.6%) |

27,055 (+434.2%) |

5,064 (+99.1%) |

590 |

|

Exports |

506,584 (+17.7%) |

430,387 (27.5%) |

337,424 (+12.8%) |

299,038 |

|

Total |

515,077 (+12.5%) |

457,442 (+33.5%) |

342,488 (14.3%) |

299,628 |

Blount Island berths

Infrastructure improvements were a feature of developments at the port of Jacksonville in 2024 and into the first quarter of this year. Jacksonville Port Authority (Jaxport) has completed the expansion of Berth 22 at its Blount Island Marine Terminal, the first of two such projects, with a combined investment of $60m. Berth 22 is now ready to accommodate more vessel calls and enable larger car carriers of 228-metre length to dock at the US port, said a spokesperson for the port authority. Construction is currently underway on the second berth (Berth 21) at Blount Island and expected to be complete in early 2027.

“The increased capability allows us to maintain open berth availability for ro-ro ships as container and vehicle volumes grow, and will increase the terminal’s throughput over time, particularly when Southeast Toyota’s new auto processing facility is complete later this year,” says a spokesperson for Jaxport.

Toyota continues to be the port’s biggest customer out of its Southeast Toyota Distributors terminal accounting for 27.8% of throughput in fiscal year 2024. That operation is now moving to Blount Island from the Talleyrand Marine Terminal once work is complete on a 31,600 sq.m vehicle processing centre currently under construction and due for completion this summer. The $145m project is funded by a combination of Southeast Toyota Distributors a $19.78m grant from the Florida Department of Transportation (FDOT) to assist with terminal development. The work incorporates additional on-site rail connections and truck loading areas. Upon completion, the facility will enable Southeast Toyota to process more vehicles through Jaxport.

The latest berth expansion is funded 75% by the Florida Department of Transportation and 25% investment by Jaxport.

| Vehicle throughput at Jacksonville (FL), US | ||||

|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

|

Imports |

368,998 (+12.9%) |

326,604 (-13.3%) |

376,718 (-3.6%) |

391,131 |

|

Exports |

140,093 (+30.6%) |

107,233 (-37%) |

170,924 (-2.1%) |

174,677 |

|

Total |

509,091 (+17.3%) |

433,837 (-23%) |

547,642 (-3.2%) |

565,808 |

|

Top OEMs by volume |

Toyota, Mazda, Mitsubishi and Volkswagen |

|||

Dependable schedules

Further up the US east coast, the Port Authority of New York and New Jersey (PANYNJ) reports a 7.6% increase in vehicle handling for 2024. Last year was marked by disruptions to port calls by ro-ro vessels, with capacity in short supply and schedules at variance. The port authority prioritised communication with port stakeholders in the operations of public berths that are utilised for ro-ro vessels. Now it says ro-ro vessel capacity has increased again and scheduling has become more reliable,

leading to a shift away from reliance on containerised vehicle shipments. In the first quarter of 2025 around 1,000 vehicles were delivered in containers. For the whole of 2024 the number of vehicles imported to the New York and New Jersey terminals in containers stood at 63,500.

A number of port-side improvement projects are helping to reduce dwell time and congestion at the ports, including the Port Street Corridor Improvement project at the northern entrance to the Newark-Elizabeth port complex, which includes a wider and safer ramp access from Port Street to Corbin Street, which is expected to open by the end of the third quarter of 2025. The project also modernises and streamlines the corridor to enable safer and more efficient truck operations.

| Vehicle throughput at New York and New Jersey (NY/NJ), US | ||||

|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

|

Import |

399,341 (+7.61%)* |

371,092 (0.4%) |

372,493 (1.57%) |

366,726 |

|

Export |

10,751 (-66.6%) |

32,269 (-54.9%) |

71,636 (-21%) |

91,300 |

|

Total |

410,092 (+1.66%) |

403,361 (-9.1%) |

444,129 (-3%) |

458,026 |

|

Top OEMs by volume |

BMW, Toyota, Ford, GM, Nissan, Volvo, Polaris, Polestar |

|||

*63,500 imported vehicles were containerised

Inland transport providers are also helping to move vehicle volumes in and out of the ports.

“Auto processors are able to maintain fluidity through peak volume periods thanks to a diversified network of transportation partners serving the local and inland markets,” says a spokesperson for PANYNJ. Those automotive processors include BMW, Toyota Logistics Services, Ports America and FAPS. “Port Newark North also has on-dock rail infrastructure, providing connections to key inland markets. The trucking community and Class I railroads that serve the port are integral parts of our Council on Port Performance (CPP), which brings together key supply chain stakeholders for regular conversations to help maintain efficiency and fluidity.”

Looking ahead at finished vehicle processing in 2025, at a board meeting held in late April PANYNJ’s port director Beth Rooney anticipated an impact on vehicle throughput in the face of vehicle import tariffs. Rooney pointed out that vehicle base prices made them more sensitive to tariffs on goods.

“There is a new tariff that will go into effect… on a per-vehicle carrying capacity basis for each car ship that arrives in the US,” she said. [There is] lots of uncertainty. We have not seen a drop off yet in our automobile volume but we would anticipate there being some impact if things don’t change.”

Infrastructure upgrades

The Port of Philadelphia (PhilaPort) imported almost 282,000 vehicles in 2024, an increase of almost 9% on the previous calendar year, with the majority of the volume accounted for by Hyundai and its luxury brand Genesis, as well as sister company Kia.

| Philaport (PA), US | |||

|---|---|---|---|

|

2024 |

2023 |

2022 |

|

|

Total vehicle units |

281,819 (+8.79%) |

259,048 (+17.2%) |

221,000 |

| Vehicle throughput at Philaport in Q1 2025 | ||

|---|---|---|

|

2025 |

2024 |

|

|

January |

21,136 |

25,039 |

|

February |

19,955 |

21,424 |

|

March |

26,847 |

22,172 |

|

Total |

67,938 |

68,635 |

To support the growth in vehicle imports PhilaPort and its terminal operator Glovis America have been investing in infrastructure. Glovis America is present at the SouthPort Auto Terminal, Pier 122 and the Pier 98 Auto Annex. Glovis has made recent upgrades to the SouthPort Auto Terminal, which opened in 2019 with an initial investment of $110m. Philaport is also working on a new berth at the facility, which will make it the first new marine terminal berth in Philadelphia for more than 50 years. Permission has been granted for the work and most of the funding is in place with the building work expected to begin in the near future, according to the port authority.

Philaport also reports making significant investments in environmental improvements across the ports and is looking to work with Glovis on electrification. The port also says it is looking at improvements to the road network in south Philadelphia to expedite the flow of trucks onto highways and reduce idling.

With regard to the impact on vehicle storage of the 25% tariffs imposed on foreign vehicle imports a spokesperson for PhilaPort said that given the imports it receives from Mexico it is likely that tariffs will hurt the port. “As the local foreign trade zone grantee, we are working with Glovis to establish a free trade zone at the vehicle processing centre at SouthPort Auto Terminal.”

US tariffs policy has added to the problems of a slowing economy and rising inflation, which could reduce the amount of cars moving through US ports and according to PhilaPort it continues to support its terminal operators “to the degree it can” but “there is not much we can do regarding tariffs or these broader economic issues”, according to PhilaPort’s spokesperson.

VW at Freeport

Down on the Gulf Coast at the Port Freeport, VW Group of America (VWGoA) opened a vehicle terminal that it said had the capacity to import and process up to 140,000 vehicles annually for the VW Group, including Audi, Bentley, Lamborghini, Porsche and the Volkswagen brand (though how that stands given the current 25% tariff on imports from Germany and Mexico is uncertain). The facility has storage capacity for 15,000 vehicles and VW has signed an initial 20-year lease on the terminal. The Freeport facility consolidates two smaller terminals in Houston and Midlothian, Texas. It means VWGoA now operates seven ports in the US.

The carmaker said that Freeport has a wider access channel that can accommodate the larger LNG-powered vessels that VW charters for cross-Atlantic shipments with Siem Car Carriers, as well as for short-sea services from Mexico.

Cleaning up coastal California

On the US west coast there were some concerted efforts at decarbonising port operations. The Port of Hueneme, north of Los Angeles, increased throughput to 415,000 vehicles in 2024, with imports accounting for 98% of volumes, led by Hyundai, Kia, BMW, JLR and GM. “Calendar year 2024 was a strong year with consistent quarterly volumes accounting anywhere between 23%-27% of total annual auto volumes,” said a spokesperson for the port. “This consistency allowed for efficient flow of vehicles through our processing facilities.”

| Port of Hueneme (CA), US | ||||

|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2021 |

|

|

Import |

406,700 |

379,925 |

318,018 (+12%) |

283,447 |

|

Export |

8,300 |

_ |

_ |

_ |

|

Total |

415,000 |

379,925 |

318,018 (+12.2%) |

283,447 |

The port company is supporting that growth with upgrades to infrastructure around which its plans for zero-emission operations revolve. The port has been working since 2018 to secure the planning and engineering required to build out not only the electrical power infrastructure system but also the port facility infrastructure. That is supported by significant funding, including $79.8m for its strategic Port Action, Climate, and Environment Development (Paced) project, which is coupled with an additional $25m in federal, state and local grants. The combined funding will go to remove dilapidated and obsolete buildings, as well as support shoreside power and emission control systems to make vessel calls zero-emission. It will also help the port procure zero-emission, cargo-handling equipment, and support the engineering and design for a new parking structure to be located on the North Terminal. As zero-emission equipment is delivered, the older diesel-powered equipment will be removed from service at the port.

“Further, the project brings efficiency and safety improvements with deepening of berths that will also allow for renourishment of local beaches with clean dredged sediment,” said The Port of Hueneme’s spokesperson.

Earlier this year, The Port of Hueneme also signed an MoU with global ro-ro operator NYK for a Green Automotive Shipping Corridor between Japan and Southern California.

“The Green Corridor MOU solidifies the commitment of both parties to explore innovative and sustainable shipping practices, with an emphasis on reducing greenhouse gas (GHG) emissions, advancing energy efficiency, and promoting the use of alternative fuels and zero-emission technologies,” said the port spokesperson. “The partnership will also explore joint research and development efforts to push the boundaries of green technology in the maritime and automotive sectors.”

Hueneme has already started project implementation of its $100+m funding awards from the last two years. According to the port’s spokesperson, “decarbonisation success begins with, and is built upon, a solid foundation of modernised, robust infrastructure”. That includes wharves, docks, fendering systems, paving and buildings built to be ready to support decarbonised electrical infrastructures and zero-emission equipment including trucks, tractors, shorepower systems and forklifts.

“The other essential element in this effort is ensuring that these systems are engineered and constructed to be built for upcoming, baked-in climate change threats,” said its spokesperson. “Threats such as sea level rise and, more immediately, climate change driven storm flood inundation, which hit the Port in December of 2023.”

The damage from that flood caused more than $50m in damage in just a few hours and since then the port has been conducting extensive modelling of such threats to understand the risks and how to build in resilience to weather-related disruptions.

Tri-Gen at Long Beach

One of the high points in 2024 for the Port of Long Beach authority, which counts Mercedes-Benz and Toyota among its biggest customers, was the opening at Toyota’s vehicle processing centre (VPC) of a renewable hydrogen and electricity system. The Tri-Gen system at Pier B makes the Toyota VPC the first in the world to be exclusively powered by onsite-generated, 100% renewable electricity.

| Vehicle throughput at Long Beach (CA), US | |||

|---|---|---|---|

|

2024 |

2023 |

2022 |

|

|

Import |

249,542 (+0.17%) |

249,105 (+9.3%) |

227,849 |

|

Export |

19,413 (-12.1%) |

22,078 (-5.0%) |

23,243 |

|

Total |

268,955 (-0.82%) |

271,183 (+8.0%) |

251,092 |

The Tri-gen system uses biogas to produce renewable electricity, renewable hydrogen and usable water, and it is capable of generating up to 1,200kg of hydrogen a day. Water is a byproduct of this hydrogen generation, and the facility can produce up to 1,400 gallons of usable water for the terminal’s car wash operations. Combustion free, the process is the first in the nation, reducing more than 9,000 tons of carbon dioxide emissions and 6 tons of nitrogen oxide (Nox) emissions. This year the port of Long Beach is celebrating the 20th anniversary of its Green Port Policy.

| Q1 throughput at Long Beach | ||

|---|---|---|

|

2025 |

2024 |

|

|

Import |

53,834 |

56,531 |

|

Export |

3,189 |

4,590 |

|

Total |

57,023 |

61,121 |

Improvement for Pasha

Pasha Automotive Services (PAS), which provides vehicle terminal services at the National City Marine Terminal in San Diego, as well as at the ports of Grays Harbor and San Francisco, says vessel capacity has been steadily improving with more new builds setting sail and the prospect of Wallenius Wilhelmsen’s 11,700-CEU capacity Shaper vessels arriving in 2027.

Import volumes were down at San Diego to 329,000 last year (-14%), which PAS put down to a dynamic market influenced by various factors but said it also saw an increase in vessel inbound units and a decrease in truck inbound units, which resulted in increased revenues because of the port tariff differential. The company is forecasting volumes of 333,000 at the National City Martine Terminal in 2025

The company says it has invested in a new terminal operating system supplied by technology provider Inform, which will optimise movement, help with capacity planning and improve overall efficiency.

Pasha Automotive Services

| Terminals | Vehicle units processed |

|---|---|

|

National City Marine Terminal (San Diego) |

329,000 |

|

Grays Harbor |

48,000 |

|

San Francisco |

30,000 |

|

Top OEMs by volume |

Hyundai/Genesis, Toyota, GM, Volkswagen |

READ ABOUT INVESTMENT AND DEVELOPMENTS AT CANADA’S PORT OF VANCOUVER

Tariff impact on trade

In the first quarter of this year ports in the US have been dealing with a great deal of uncertainty related to the constantly changing trade policy of the Trump administration, which has increased tariffs on vehicle imports and is planning to apply additional fees on car carrier vessels with a foreign origin calling at US ports from October this year. The blanket 25% tariffs applied to all foreign vehicle imports was under review as Automotive Logistics went to print, with a renegotiation between the US and UK resulting in a maximum of 10% being applied to UK vehicle imports up to an annual cap of 100,000 units. Some hope that move will lead to a cascade of renegotiation with other trading partners.

Regarding the fees proposed by the US Trade Administration on foreign vessels, car carriers made anywhere other than the US will be hit with a fee of $150 for every equivalent unit (CEU) they are carrying following an assessment after first US port entry. The US Trade Representative said that to incentivise US-built car carrier vessels it would not limit the fee only to vessels built in China (as it is for other vessel types) but has applied the fee to any foreign-built car carrier vessel. If the owner of a non-US-built vessel carrier orders and takes delivery of a US-built vessel of the same or greater capacity, it can obtain remission of fees paid for up to three years.

For other vessel types owned or operated by Chinese companies, including container carriers, the fees will start on October 14 and vessels will be charged $50 per net ton, increasing to $140 per net ton by April 17, 2028. Vessels built in China will be based on net tonnage or container volume, whichever is higher. Those fees will apply from October 15 this year and increase incrementally over a three-year period until April 17, 2028, beginning with $18 per net ton, increasing up to $33 per net ton, or $120 per container, increasing up to $250 per container. The fee is assessed per each rotation or string of US port calls.

These fees, combined with fluctuation tariffs on finished vehicles imported from abroad has caused uncertainty and resulted in many port authorities and terminal operators holding off on making their plans public, but it has also led to a build-up of vehicles at the ports of entry in certain cases.

Weighing the cost

At Baltimore the Maryland Port Administration (MPA) says it is continuing to monitor the tariff actions and is seeing an impact.

“Some of our auto manufacturing customers are shipping into US ports, such as Baltimore, but holding their vehicles at the port of entry,” said the MPA’s spokesperson. “Some are adding import fees, and others are absorbing the tariffs.

Imports account for 85% of the vehicles handled at Baltimore port but MPA also expects to see impacts on its container business, especially on imports from China, though they are not likely to show until June, according to MPA’s spokesperson.

“Ultimately, the impact of tariffs on the port of Baltimore, and all ports, will depend on the length of time that tariffs are implemented in addition to the decisions of shippers to send their products to the US,” he said.

Current US trade policy, including proposed vessel call fees on China-built or operated vessels, is expected to affect business port of Los Angeles in 2025. “The port is expecting to see a decline in overall cargo in the second half of the year by at least 10% compared to 2024,” said its spokesperson. “As prices begin to rise, consumers will likely reconsider many of their purchases, including foreign-made automobiles.”

Finished vehicle logistics provider, Wallenius Wilhelmsen, which manages terminals at a number of ports in North America, says that it expects to see a decline in US imports and possibly exports, adding that tariffs and potential port dues may impact global trade and growth. However, Lasse Kristoffersen, president and CEO of Wallenius Wilhelmsen, said in a statement that the company was seeing growth in other regions, notably out of Asia, and that the company is well positioned to benefit from new trades and opportunities that emerge if existing trade lanes alter and regional needs grow as a result.

In April this year Wallenius Wilhelmsen acquired the remaining shares in New Zealand-based shipping company Armacup, which has led in the Japanese used car trade since the 1980s.

Terminal operator Amports is also trying to look on the bright side. “We are hoping that as the UK has reached a deal we will start to see a cascading relationship of other deals that everybody is more comfortable with,” said Mark Boucher, chief commercial officer at Amports. However, there is less room for optimism regarding the US Trade Representative fees on foreign car carriers visiting US ports.

“The $150 fee per CEU – that is a cost that is just going to be passed straight through to the end consumer, it is unfortunate,” said Boucher. “It sounds like that is pretty well set but the US is now in active negotiation so maybe we can get some relief on it.”

For more, read our latest European ports review, to find out how lower car sales in Europe and disruption to routes in the Red Sea corresponded with a drop in volumes at a number of leading European vehicle terminals in 2024.

Topics

- Analysis

- Data

- Data Analysis & Forecasting

- Deep sea

- Editor's pick

- features

- Finished Vehicle Logistics

- Fleet & Route Optimisation

- Home Page

- Just-in-Time

- Lean Logistics

- Logistics IT

- Nearshoring

- Nearshoring Strategies

- North America

- Ports and processors

- Shipping

- Supply Chain Planning

- Technology & Automation

- Trade & Customs

North American ports review: The best laid plans

- 1

Currently reading

Currently readingNorth America’s vehicle handling ports are investing in strength to manage volatility

- 2

- 3

1 Reader's comment